Business Assets

A business that generates profit for its owner(s) is a collection of business assets. These are the building blocks that, when combined, create profit.

These building blocks can be anything that's involved in creating profit for its owner.

Old School Business Assets Are Costly

Old school business assets include physical equipment, product inventory, vendors, locations and humans to perform work processes.

All of those business assets have a cost that is upfront, ongoing or both.

Old school business ownership is risky because it requires hundreds of thousands of dollars, or more, to start. You have to risk losing that money to get a chance at making a profit.

It often takes 5 to 7 years to break even. Among businesses that survive, only 40% make a profit.

In other words, there is unfavorable asymmetric risk:reward. For example:

- Risk

- $600,000 (Startup Cost)

- Reward

- Year 1: Loss

- Year 2: Loss

- Year 3: Loss

- Year 4: Loss

- Year 5: Break even

- Year 6: $100,000 profit

This is asymmetric because one is bigger than the other. The $600,000 risk is bigger than the $100,000 reward.

It's unfavorable because the risk is larger than the reward.

It's even more asymmetric and unfavorable if you count inflation.

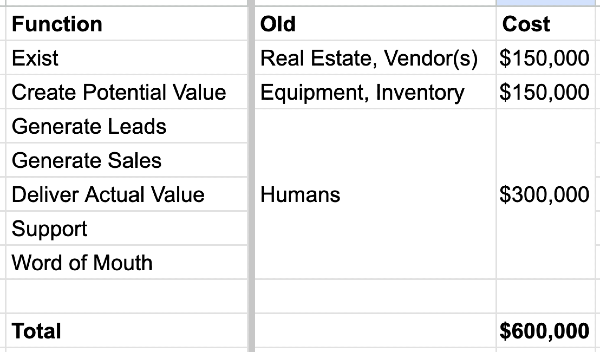

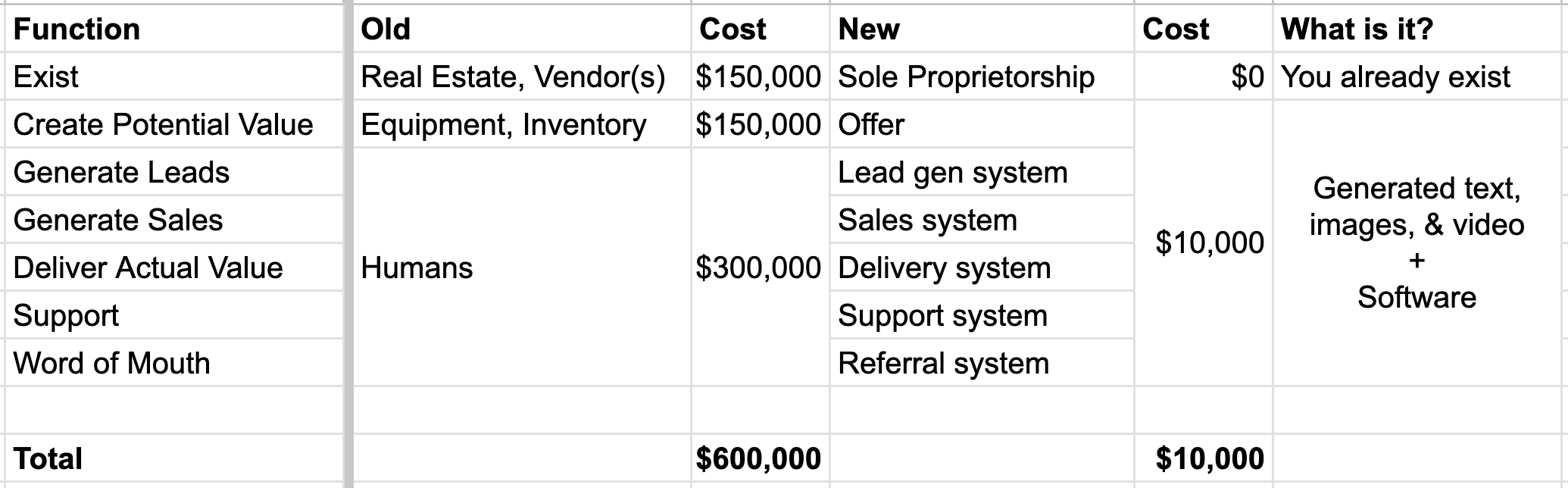

Here is a typical breakdown of the startup cost of business assets to hopefully carry you through to break even:

Debt Leverage

Old school businesses often use debt as leverage to reduce out-of-pocket startup costs. Debt is a double edged sword in that it increases total costs (interest).

Debt leverage gets people in the game who couldn't otherwise afford the table stakes.

It increases the chance of failure, but creates the chance of success for those who need it to start.

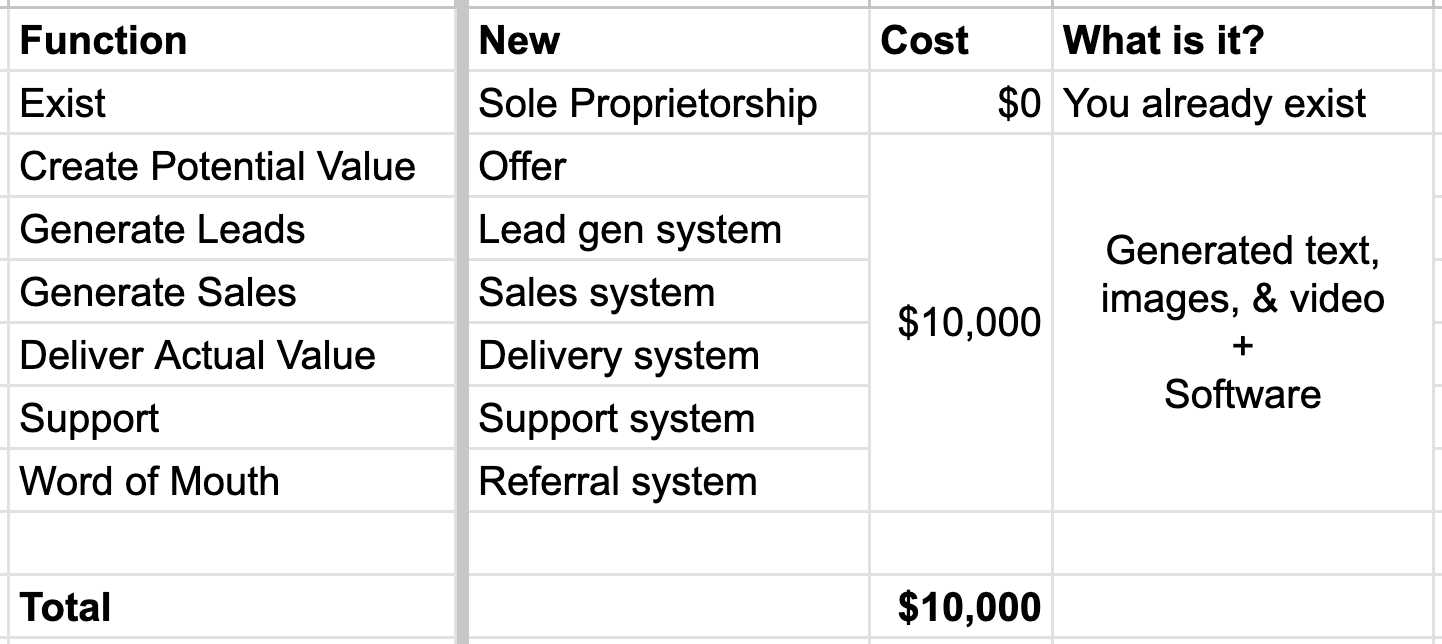

New School Business Assets Cost Almost Nothing [Digital Leverage]

New school business assets are different because they provide smart leverage.

Leverage is anything that makes big outputs from small inputs. Like the slingshot that little David used to defeat big Goliath.

New school business assets carry much greater leverage than those of the past.

While it may take only $10,000 to get a new school business to break even, the potential reward is unlimited.

Smart Leverage

The cost of generating $1,000,000 of profit is virtually the same as $100... when using smart leverage.

Smart leverage is costless. It increases the chance, magnitude and speed of success.

Why most people don't use Smart Leverage

Smart leverage requires you to be a contrarian and Early Adopter.

(most people aren't)

The Opportunity with Business Assets

The main functions of a business are:

- Exist

- Create potential value

- Generate leads

- Generate sales

- Deliver actual value

- Support buyers

- Generate/capture word of mouth

The majority of business owners are relying on the costly option.

This isn't because old school business assets are better. They're clearly worse, albeit comfortable and familiar.

Most choose comfort over bigger reward due to a flaw in our brains.

The good news is that you can override your brain's wiring and choose to become an Early Adopter.

Join the Transformation Economy

for Higher Profit, Purpose, and Peace