This picks up where a previous post left off. You may want to read that post first in order for this one make sense.

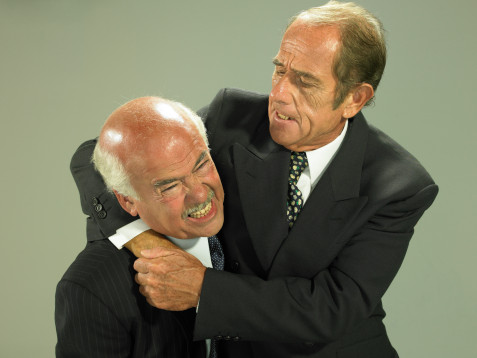

Looking at the picture above, I can only imagine that this is the way that the following idea was made into government policy. The second major way BLS’s CPI calculation policies were altered is through the concept of subsitution. In brief, this concept argues that as the price of an item rises, consumers start buying cheaper alternatives.

Consumer substitution is absolutely true. It’s a fact; we all do it. It’s a sign of inflation. We know there is significant inflation when prices of things we buy go up in price. Everything doesn’t go up equally all at the same time. As prices are rising, consumers will substitute goods to get the best deal. BLS uses this concept to reduce the mathematical weighting of items in their basket of goods that rise sharply in price. It is an assumption that when things rise in price, we seek alternatives that are not rising as rapidly in price, and we will remain satisfied. The insanity in this statement is that the consumer is “satisfied” as evidenced by their seeking alternatives. The actual reason the consumer is seeking alternatives is because they have to. If their income didn’t rise and prices did… something’s got to give, and its spending. They have to figure out a way to make do, and that is considered by BLS to evidence “satisfaction” and justify ignoring the actual price rises at their face value.

In 1998, this concept of a “satisfied consumer” completely broke CPI off into its own category. CPI no longer measures rising prices… it measures rising consumer spending. If prices rise by 50% in a year, most consumers are unable to raise their spending by 50% per year because their earnings are fairly stagnant.

To summarize, consumer substitution is a sign of inflation. BLS has been convinced by politicians to use consumer substitution as justification for removing inflation from inflation. Huh? So the CPI is a way to measure inflation (rising prices) without equal mathematical weighting for items that are rising rapidly in price.

Think of it in simple terms of a math equation like “2 + 2 = 4”. One one side of the equation you have an actual calculation, and on the other side you have the result of the calculation. Measuring real inflation uses an absolute formula on the left side of the equation to output an accurate figure on the right side. Unfortunately, the substitution adjustment to CPI has made public policy out of adjusting the left side of the equation to ensure that the right side always reads 6% or less. These ridiculous adjustments were made policy in the early 90s, CPI has never been reported at above 6% since then, and CPI will likely never be reported above 6% in the future (regardless of the dollar’s decline and rising prices) as long as these silly adjustments remain in place.

Don’t believe me?

Allow me to provide links to official government pages documenting these ridiculous concepts of hedonics and substitution. They are not nearly as straightforward as my writings; instead the reality of what they are talking about in these documents is hidden amongst a bunch of boring, lengthy, technical, gobbldygook language… but nonetheless there it lies for the verification purposes of anyone who doubts the unreliability of official CPI figures.

SSA Boskin Report – This was a commission report from the Social Security Administration. It basically complained that inflation was being overstated and that many complex adjustments needed to be put into practice for CPI calcuations.

Gramlich’s Congressional Testimony – Governor Edward Gramlich testified to the House of Representatives. It talks about recent “improvements” in calculations, but then pleads for “substitution bias” to be “corrected”.

BLS Handbook of Methods – This document basically uses fancy terms and confusing, complex language to explain how they do their calculations, including the laughable concepts of “hedonics” and “substitution bias”. Search the PDF for those terms.

The theme within all of these government documents is complaints of CPI being overstated for various complex and nebulous reasons. These testimonies and reports have resulted in the calculation policies to be altered as requested. I’ve haven’t been able to come across any government documents of reports or testimonies that involve a complaint of CPI being understated. The result is that many complex arguments are made, and over time CPI calculation is reformed repeatedly in ways that reduce the reported CPI, but never in a way that increases the reported CPI.